Maintain Vendor Record

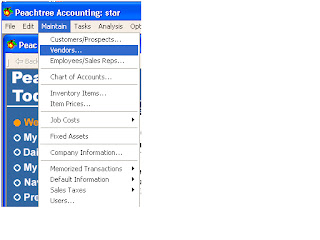

Maintain vendor record click maintain and

vendor and display the maintain vendors window.

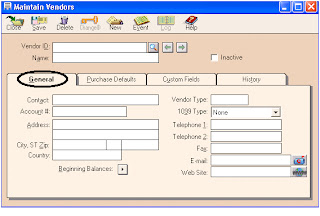

Circle portion is called header fields and in

this portion we enter vendor ID and name.

In general tab enters basic information about the vendor such

as contact information, address, phone and fax numbers, and beginning balances.

In purchase defaults you can change

this information at the transaction level. In purchase rep you can enter or select an employee to act as

the purchase rep. In purchase account Enter a Ledger account for the default

purchase account for this vendor. Tax Id is not use in Pakistan. In terms you can choose to use the standard vendor payment terms

vendor. Select the Terms button to change the payment terms. And then click

custom fields display the following window.

In custom field information for the selected vendor record.

And then click history tab following window will appear.

Vendor Since: Enter the date you first had a transaction with the vendor.

Last Invoice Date: Enter the date of the last invoice you received from the vendor.

Last Invoice Amt.: Enter the amount of the last invoice.

Last Payment Date: Enter the last date you paid the vendor.

Last Payment Amt.: Enter the last amount you paid the vendor.

Last Invoice Date: Enter the date of the last invoice you received from the vendor.

Last Invoice Amt.: Enter the amount of the last invoice.

Last Payment Date: Enter the last date you paid the vendor.

Last Payment Amt.: Enter the last amount you paid the vendor.

Default Information of Vendors

The next step is the default

information for this we will be go to the menu of maintain where select the

default information and then select the vendors in sub menu such following are.

After this it will be appear

a window such as following

Payment term:

Here different option of the vendors default, accounting,

custom fields, and 1099 settings. Now I will discussed all steps such are

C.O.D (cash on order):

Cash an order

mean cash received when the goods was sale .which window such as following.

Here the net due, discount in, discount % cannot mention

because the cash had already receive.

Prepaid:

Here mean the cash are send to seller for order the goods

before collected the goods.

Here also not give discount and net due.

Due in number of days:

When the something is purchase sometimes the goods are purchase

on credit base. So in this the time is give discount such as 3/10, n/30. Its

mean seller give 3% discount on the sale if the buyer pays the amount in 10

days while total credit time is 30 days.

Here they also enter the ID of the purchase general ledger purchase account.

Due on day of next month:

Its mean the due will be on

next month of the day

Due at end of date:

Its mean the due will be the

end das of the month.

Account aging:

This tells about the account

aging by two methods invoice and due date. Here we also fill the payment days

with your choice period.

Custom field:

This tells about the information about the customer which we

can blank labels can fill with his choice.

.